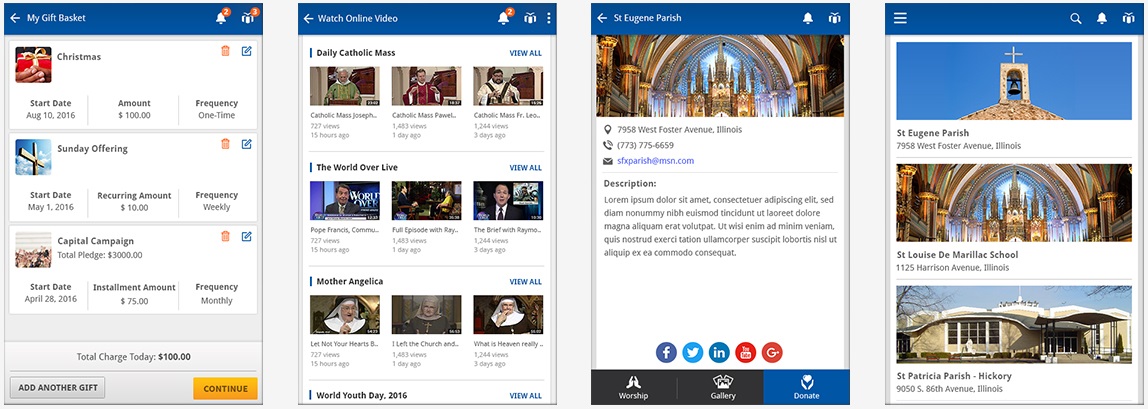

Online giving or e-giving options are simple no matter what your cause is or who your donors are. Not only is it easier but also secure. Institutions of faith and religion are no exception. While traditional way of collecting offerings at churches still stand, the ability to donate online and through your phone remotely has greatly increased collecting efficiency.

Technology is changing habits. According to the U.S. Census Bureau’s report, the age group of 18-49 years makes up the major part of the population of our society today, about 63 percent. And in future, as this generation moves into middle age they will bring along their knowledge of technology to make their life easier. This will have a significant effect on the collection capability of the churches, which for the time being are dependent only on weekly church attendance.

In a survey by the Gallup Organization, based on over 150,000 it was found that only 35 percent of the total attended church weekly. The rest admitted to rarely attending the church and some even agreed to not attending at all for months. Based on this survey it is hard to agree to the traditional form of donation collection in churches. Right now the attendance to churches is the only guarantee to collecting offerings. Add to that the cost of handling cash, budgeting and lack of collection strategy and giving becomes a challenge.

Here are some of the reasons why your organization should consider e-giving:

Popular consent

The majority of people use online payment methods for paying bills and other activities. A large majority admitted to writing checks only when donating to a church or any other non-profit which could not offer online payment method. Some churches who adopted online giving saw an increase in the number of donations every year. Though the success of programs likes these depends mostly on how they are introduced and promoted, most people find it more convenient than the traditional method.

Decrease in use of checks

Seldom will you find someone who carries a checkbook to services. Most of the time rarely do we carry a lot of cash in our wallets. So if the church offers only these two methods of donating, the person will either give nothing or donate as little as he/she has at the given time. We know that with the boom in digital transactions people mostly use their debit or credit cards, or other online transaction methods to manage their finances.

Reliable collection option

Many programs which offer online payments have the feature of Electronic Fund Transfer (EFT). Basically, people can transfer funds to the payee on a fixed timeline. How one can use this is by designating the church as the payee and then the payment will happen automatically on a weekly basis or bi-weekly, however, the account holder wants. This makes it very convenient for the church to collect donation throughout the year. The flow of donation is stable and reliable too.

Many churches that have adapted to this trend have seen an incredible increase in donations. Especially families that are traveling during summer vacations like to keep their faith alive and do make the donation even when they are away. Many people who travel a lot can sometimes feel disconnected to their faith. With this option, it will be easier for such people to make donations from remote locations to their home church and feel connected and faithful to their faith. Time and space become the least concerning factor when using EFT and the church can concentrate on the faith of the congregation any worry less about how to collect donations.

Hike in donations

Online donations gain increased popularity – think of crowdfunding you recently participated in as one example. The ease, convenience and securing are the main three factors. These will only, in turn, generate more donations. Churches that offer the option have seen about 40 to 45 percentage of people using their credit card. Donation capability has increased 8 to 10 percent.

Safety

It is a major factor in any transactional process. Safety is taken seriously on all levels and are regulated by strict banking guidelines. Updates and reviews to make sure there are no loopholes are ongoing. Most importantly banks have necessary guidelines to which a merchant should adhere to. Any software solution you choose has to meet these guidelines in order for any transaction to be made with a bank. So, weather you are making a payment or donating to a church your transaction as well as personal information is treated with utmost security.

Ease of Donation

As mentioned before online transaction gives the great capability to people to donate at their leisure. Many families who can’t schedule their weekly church visit can still schedule their weekly support with electronic fund transfer. They don’t have to be concerned about attending each and every occasion to support their faith. With e-giving, they can donate regardless of their busy schedule. They can also frequently donate as much as it’s affordable to them and predict a budget for their own convenience. Giving the ability to manage how they donate can greatly increase the donations.

Broadening supporter age group

Baby boomers make the majority of donors today. But the younger generation who are also enthusiastic about supporting their faith are large in number. This new age demographic that is tech savvy and uses their mobile devices for most of their finances, will generally be inclined to use online payment methods. Giving them the option of online payment will only draw them more towards supporting their church.

E-giving is a trend. It is here to stay and will only grow exponentially every year. Church leaders must react to this change in donor behavior and adapt accordingly. Learn more about our online donation management tools.

church app church offering church tools e giving giving in church

Last modified: July 20, 2017

I’ve been using CBD gummies in search or [url=https://www.cornbreadhemp.com/blogs/learn/cbda-vs-cbd ]cbd and cbda[/url] a year today, and I can’t feel how much they’ve improved my life! The flavors are motionless savoury, making it a pleasing renounce of my habitually routine. My anxiety and stress levels contain significantly decreased, and my sleep calibre has improved tremendously. I wake up sensibility more refreshed and energetic. Be that as it may, I’ve noticed a crumb of drowsiness during the era, and I wish the effects lasted a whit longer. Ignoring these minor issues, I approvingly push these CBD gummies in the service of anyone looking to enhance their well-being normally!

I’ve been using CBD gummies after or https://www.cornbreadhemp.com/products/cbd-sleep-gummies a year now, and I can’t feel how much they’ve improved my person! The flavors are motionless engaging, making it a pleasing part of my habitually routine. My dread and distress levels partake of significantly decreased, and my catch distinction has improved tremendously. I wake up premonition more refreshed and energetic. Even so, I’ve noticed a jot of drowsiness during the lifetime, and I wish the effects lasted a bit longer. Ignoring these minor issues, I much advocate these CBD gummies after anyone looking to enrich their well-being clearly!