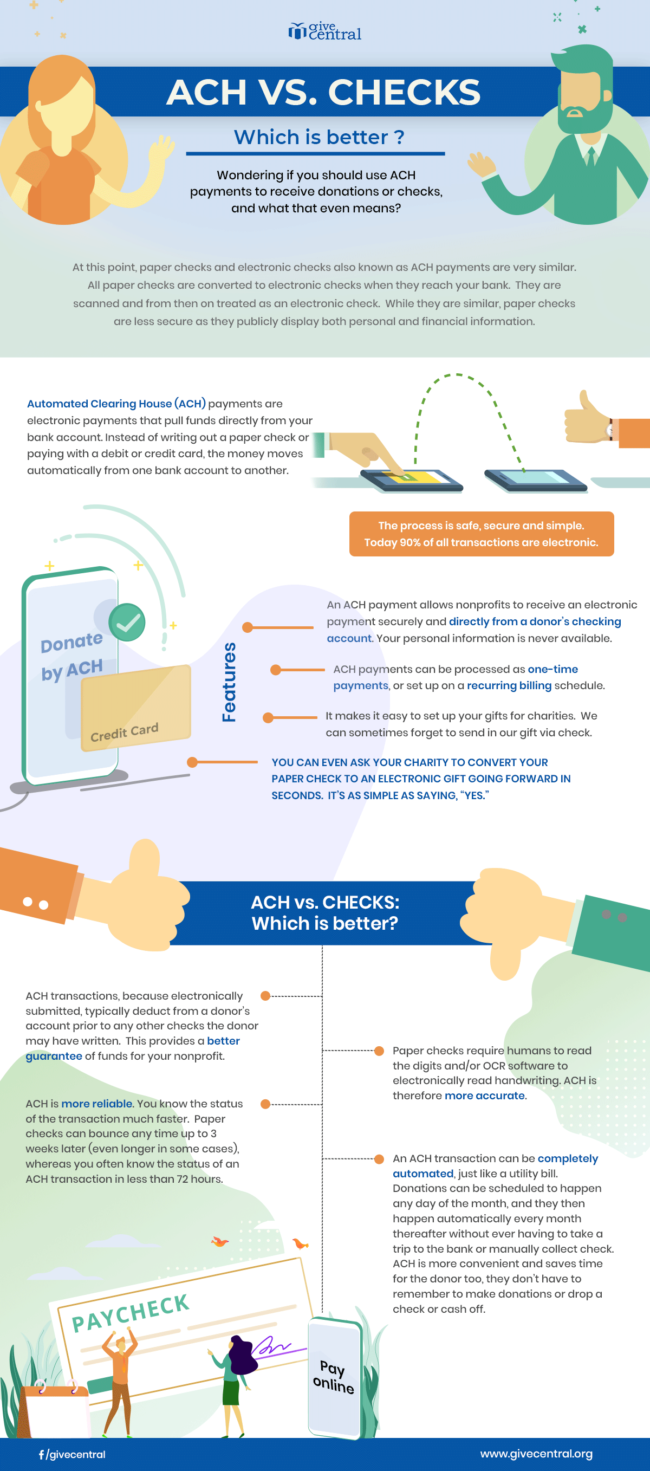

Wondering if you should use ACH payments to receive donations or checks, and what that even means?

At this point, paper checks and electronic checks also known as ACH payments are very similar. All paper checks are converted to electronic checks when they reach your bank. They are scanned and from then on treated as an electronic check. While they are similar, paper checks are less secure as they publicly display both personal and financial information.

Why nonprofits should use ACH?

Benefits all around

Electronic payments are popular for several reasons.

Better retention and Increased on-time donations

With ACH payment processing, donors can set up recurring donations that are directly debited from their bank accounts. Allowing donors to set up recurring donations automatically boosts your donor retention rates.

Security

For donors who are not comfortable sharing their bank account details online, ACH payment processing is perfect since it uses encryption to essentially jumble the bank account numbers, keeping the info safe from hackers. You also have to share your details only once, when you are setting up the payments. When writing checks, your information is exposed monthly.

Autopilot

If using automatic ACH payments, donors do not need to keep an eye out for bills—or take action when payments are due.

Less Follow Up

Everyday charities are spending hundreds of hours following up on pledges and gifts that may have been missed accidentally. This work is minimized and eliminated with ACH.

Long-distance payments

Nonprofits can accept payments by ACH remotely.

Reach donors without Credit Cards

All your donors might not carry a credit card with. ACH payments enable them to give online.

Track of income and expenses

With every transaction, banks create an electronic record. Accounting and personal financial management tools can also access that transaction history.

Easy to handle

Record keeping takes effort and resources. With checks one has to forward the checks to the bank and also wait for a few days to see if the checks were successfully processed. ACH payments eliminate the need for manual intervention. The process of money exchange between two accounts happens online, which makes the process quicker, safer and reliable.

Automated Clearing House Checks electronic donation Infographics nonprofit organization payment platform

Last modified: April 30, 2025

Thank you so much—I found exactly what I was searching for. You’ve ended my four-day search! Bless you, and have a great day. Goodbye!