Before you start a major marketing campaign for your nonprofit association or plan to introduce a new product or service, you need to be sure that your donors want what you are offering. Imagine working hard on a new service for months only to find out that your audience just isn’t ready for it!

Research surveys can help you find the interests of your community, provide a thorough understanding of your existing business and also help explore new opportunities in the marketplace.

Conducting a survey however, can be more difficult than it seems. At least for quality results.

Here are some tips from us at GiveCentral to help you get started.

Set up a survey to probe your non-profit association’s community with these 7 golden rules.

1. Before getting started ask yourself

- Why do you want to do this survey?

- Who would be your target audience?

The survey must be specific to a target because its nature and the conclusions to be drawn will depend greatly on the target. You can survey your volunteers or employees to make improvements within the organization.

You can also know the satisfaction of your donors and the prospects of their growth.

- What question are you trying to answer?

Write the problem to which this survey responds. Poll Rule: A survey always answers a question.

2. How to structure it?

Some tips to increase your response rate:

- Choose your non-profit survey title and subtitle

- Consider adding a description where you set the context, explain the issues involved in the survey and why it is important that they complete the survey

- Give an end date to the survey, and put it forward so as to avoid procrastination. It’s now or never!

- Start with broad questions and get into the details as you go.

3. What kind of questions to ask?

Questions should be short. Between 5 and 15 words. The respondent does not want to spend too much time taking questions. Answering your survey should be easy and quick.

Questions must be clear. Use simple and appropriate vocabulary. Even if the questionnaire is aimed at professionals, avoid the use of jargons.

Questions must be relevant. Stick to a subject. The respondent must understand why you are asking a particular question.

Also be careful not to ask personal questions. Even if your survey is anonymous, you would lose in response rate.

4. What kind of survey response options to use?

There are two formats you can choose from- structured (where the respondent is allowed to select a response from pre-existing choices) or unstructured (open-ended) response formats.

While the structured formats are used for greater efficiency and ease, the unstructured survey response formats are a more popular choice for qualitative research.

Some advantages and disadvantages of the most frequently used survey formats for market research are:

Single choice closed question

+ Fast and simple

– Limit

Closed multiple choice question

+ More open but still easy to strip

– Some proposals are sometimes chosen without real conviction

Ranking

+ Allows accurate comparisons and results

– Difficult to put in place

Open question

+ Leave a Reply

– Long to answer: may scare the respondent (be sure to leave the answer optional)

– Little response rate

– Long to strip

5. Who will be your target audience?

Sample and population

- The population is the number of people who make up the group you want to interview.

For example, if you want to better understand the behaviour of your donors, your population is the number of donors your non-profit association has: 150 for example.

- The sample is the number of people in this population who responded to your survey.

You send your survey by email to your 150 donors. Only 50 respond: this is the size of your sample.

How large should my sample be compared to my population?

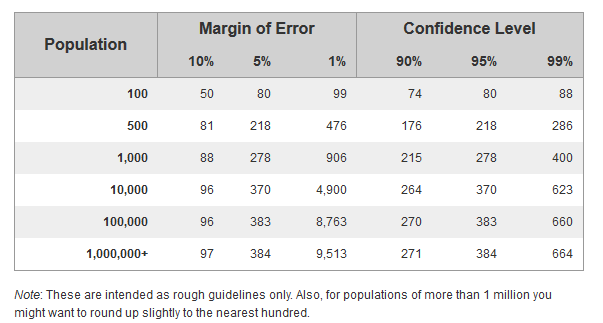

The table below shows you the size of the sample you need to get meaningful results.

Source: https://www.surveymonkey.com/mp/sample-size/

Thus, it can be seen that the larger the size of the population, the less the proportion of respondents to be interviewed.

When is a sample representative of my population?

A margin of error of 5% and a confidence level of 95% according to the sample size shown above guarantees good reliability and very significant results.

6. How to administer the nonprofit survey?

There are multiple ways to administer a survey depending on the size of the population and the number of questions you may wish to ask. Each method has its pros and cons.

Face to face:

+ Helps if the questionnaire is complex / long

+ High response rate

– Costly and long

– Long analysis

By email:

Send a questionnaire + a cover letter + return envelope or propose a return by hand

+ Accessible to all: can reach all our members without exception

– Low response rate

– Expensive

– Long analysis

Online survey:

Put your non-profit online survey on the website, and send an invitation to reply by email. You can use solutions like Google Form, Survey Monkey and GiveCentral’s donor management system.

+ Automatic scoring

+ Anonymity of responses if desired

+ Allows some tools to have a graphical view of the results

– Need to have internet to answer: discriminating (less and less however)

The people who respond to the surveys must be randomly selected if our population is to be represented. Be careful, therefore, that administering your online survey does not distort the results. There is a risk of missing out on the representation of elderly people without internet access, those who rarely consult their emails or rarely visit your website.

7. What to do with the results?

The analysis of the results is an essential step.

The results must make it possible to answer your initial questions and put in place concrete actions.

Be sure to remain objective in your analysis, because some answers can be misinterpreted. To remedy this, you can work with several hypothesis.

It is important to communicate the results of your non-profit survey to the community.

People who have taken time to answer your questionnaire will be delighted to have this information. Your nonprofit association can use various communication tools such as, the website, monthly newsletter or email.

donor management software GiveCentral Community givecentral donation software market research marketing for nonprofits survey for non profits survey research

Last modified: April 28, 2017